Iindigo Mobile Pay: Your Ultimate Guide

iindigo Mobile Pay: Your Ultimate Guide

Hey guys! 👋 Today, we’re diving deep into the world of iindigo Mobile Pay . If you’re anything like me, you’re always on the lookout for ways to make life easier and more convenient, right? Well, buckle up because iindigo Mobile Pay might just be the game-changer you’ve been waiting for. We’ll cover everything from what it is and how it works to why you should consider using it. Let’s get started!

Table of Contents

What is iindigo Mobile Pay?

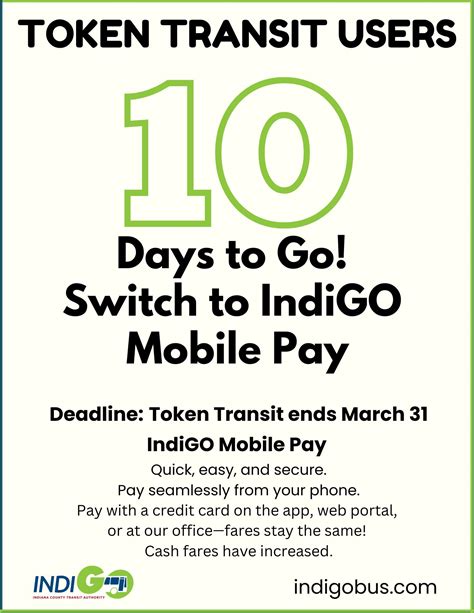

Okay, so what exactly is iindigo Mobile Pay? Simply put, it’s a mobile payment solution that allows you to make purchases using your smartphone or other mobile devices. Think of it as a digital wallet that lives on your phone. Instead of fumbling around for your credit cards or cash, you can just tap your phone at the checkout and bam —payment made! This is especially handy when you’re juggling a million things at once, like groceries, kids, and that ever-elusive parking ticket. 😎

The magic behind iindigo Mobile Pay lies in Near Field Communication (NFC) technology. NFC allows devices to communicate wirelessly over short distances. When you tap your phone on a compatible payment terminal, the NFC chip in your phone transmits your payment information securely to the terminal. This happens in a matter of seconds, making it a super-fast and efficient way to pay. Many smartphones and payment terminals now come equipped with NFC, making iindigo Mobile Pay a viable option for a growing number of people.

But it’s not just about NFC. Iindigo Mobile Pay also supports other payment methods, such as QR codes and in-app purchases. QR codes are those funny-looking squares you often see at checkout counters or in advertisements. To use a QR code with iindigo Mobile Pay, you simply scan the code with your phone’s camera, and the app will process the payment. In-app purchases, on the other hand, allow you to make payments directly within mobile apps. This is super convenient for things like ordering food, buying movie tickets, or subscribing to your favorite streaming service. In essence, iindigo Mobile Pay aims to be a versatile and all-encompassing payment solution that caters to a wide range of needs and preferences.

How Does iindigo Mobile Pay Work?

Alright, now that we know what iindigo Mobile Pay is, let’s get into the nitty-gritty of how it actually works. Setting up iindigo Mobile Pay is usually a breeze. First, you’ll need to download the iindigo Mobile Pay app from your device’s app store (whether you’re team Apple or team Android). Once the app is installed, you’ll need to create an account and link your preferred payment methods. This typically involves adding your credit or debit card information, but some services also allow you to link your bank account directly. Safety first, of course, so make sure the app uses robust encryption and security measures to protect your financial data. 🔒

Once your payment methods are linked, you’re pretty much good to go! When you’re ready to make a purchase, simply open the iindigo Mobile Pay app and select your desired payment method. If you’re using NFC, just tap your phone on the payment terminal. You might need to enter a PIN or use biometric authentication (like a fingerprint or facial recognition) to authorize the payment, depending on the security settings you’ve chosen. For QR code payments, just scan the code with your phone’s camera, and the app will guide you through the rest of the process. And for in-app purchases, the app will typically handle the payment seamlessly in the background.

One of the cool things about iindigo Mobile Pay is that it often integrates with loyalty programs and rewards systems. This means you can earn points or receive discounts automatically when you make purchases through the app. Some apps even allow you to store digital versions of your loyalty cards, so you don’t have to carry around a wallet full of plastic. It’s a win-win! Plus, many iindigo Mobile Pay services offer transaction history and spending tracking features, so you can keep tabs on your finances and see where your money is going. Knowledge is power, right? 🤓

Benefits of Using iindigo Mobile Pay

Okay, so why should you bother with iindigo Mobile Pay in the first place? Well, there are actually quite a few compelling reasons. Let’s break down some of the key benefits:

- Convenience: This is probably the most obvious advantage. With iindigo Mobile Pay, you can leave your wallet at home and pay with your phone. This is super handy when you’re out for a run, hitting the gym, or just trying to travel light. Plus, it’s way faster than fumbling around for cash or cards at the checkout. 🏃♀️

- Security: Believe it or not, iindigo Mobile Pay can actually be more secure than using traditional credit cards. Many services use tokenization, which replaces your actual card number with a unique digital token. This means that even if the payment terminal is compromised, your actual card information remains safe and sound. Additionally, you can set up biometric authentication or PIN codes to prevent unauthorized access to your account. 🛡️

- Speed: We’ve already touched on this, but it’s worth emphasizing. iindigo Mobile Pay is incredibly fast. Just tap and go! No more waiting in line while someone struggles to count out their change or swipes their card multiple times. ⏱️

- Rewards and Loyalty Programs: As mentioned earlier, iindigo Mobile Pay often integrates with rewards and loyalty programs. This means you can earn points, receive discounts, and enjoy other perks simply by using the app to make purchases. It’s like getting paid to shop! 🤑

- Hygiene: In a post-pandemic world, hygiene is more important than ever. iindigo Mobile Pay allows you to make contactless payments, which can help reduce the spread of germs and bacteria. It’s a small thing, but it can make a big difference. 🧼

Potential Drawbacks

Of course, no technology is perfect, and iindigo Mobile Pay does have some potential drawbacks to consider:

- Limited Acceptance: While iindigo Mobile Pay is becoming increasingly popular, it’s not yet universally accepted. Some merchants may not have compatible payment terminals, which means you’ll still need to carry cash or cards as a backup. 😔

- Battery Dependence: If your phone battery dies, you’re out of luck. This can be a real problem if you’re relying solely on iindigo Mobile Pay and don’t have any other payment options available. Always make sure your phone is charged before you head out! 🔋

- Security Concerns: While iindigo Mobile Pay is generally secure, it’s not foolproof. There’s always a risk of hacking or data breaches. It’s important to use strong passwords, enable two-factor authentication, and keep your app updated to minimize these risks. ⚠️

Tips for Using iindigo Mobile Pay Safely

Okay, let’s talk safety. Here are some tips to help you use iindigo Mobile Pay safely and securely:

- Use Strong Passwords: Choose a strong, unique password for your iindigo Mobile Pay account. Avoid using easily guessable information like your birthday or pet’s name.

- Enable Two-Factor Authentication: Two-factor authentication adds an extra layer of security to your account. This means that even if someone knows your password, they’ll still need a second code (usually sent to your phone) to log in.

- Keep Your App Updated: App developers regularly release updates to fix bugs and security vulnerabilities. Make sure you’re always running the latest version of the iindigo Mobile Pay app.

- Be Wary of Phishing Scams: Phishing scams are designed to trick you into giving up your personal information. Be suspicious of any emails or messages that ask you to provide your iindigo Mobile Pay login credentials or other sensitive data.

- Monitor Your Transactions: Regularly review your iindigo Mobile Pay transaction history to look for any unauthorized or suspicious activity. Report any discrepancies to your bank or credit card company immediately.

The Future of Mobile Payments

So, what does the future hold for mobile payments like iindigo Mobile Pay? Well, I think it’s safe to say that mobile payments are only going to become more prevalent in the years to come. As technology continues to evolve and more merchants adopt mobile payment solutions, we can expect to see even greater convenience, security, and functionality.

One potential trend is the integration of mobile payments with other technologies, such as biometrics and artificial intelligence . Imagine being able to pay with just a blink of an eye or a voice command! AI could also be used to detect and prevent fraud in real-time, making mobile payments even more secure.

Another trend to watch is the rise of central bank digital currencies (CBDCs) . These are digital versions of traditional currencies issued by central banks. CBDCs could potentially revolutionize the way we pay for things, making transactions faster, cheaper, and more transparent.

Conclusion

Alright, guys, that’s a wrap! I hope this guide has given you a better understanding of iindigo Mobile Pay and its potential benefits. While it’s not a perfect solution, it’s definitely a convenient and secure way to pay for things in many situations. As mobile payments continue to evolve, I’m excited to see what the future holds. Thanks for reading, and happy shopping! 🛍️